What does the future hold for health care payment reform models?

Julianne McGarry wrote this blog, which was originally published on November 2, 2020, and updated on January 19, 2021.

Tornadoes form when high-speed winds rapidly change direction around a thunderstorm, causing the air to swirl horizontally. The swirling air picks up warmer air from the ground, creating a funnel that grows longer and longer; when it touches the ground, it becomes a tornado. The thing about tornadoes – unlike hurricanes – is that they are highly unpredictable once the funnel takes shape. They can touch down anywhere. So, while scientists can predict that a tornado is coming, they cannot predict where it will make landfall.

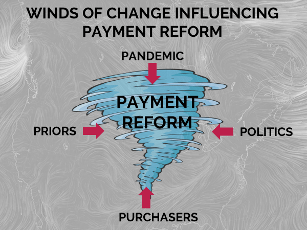

A tornado is what comes to mind when thinking about the future of alternative payment models (APMs). It’s not because the health care ecosystem (let alone APMs) are poised to wreak horrific destruction upon us all.[1] Rather, the tornado analogy derives from the powerful and influential forces blowing the APM movement in multiple and conflicting directions. The result is swirl.

A tornado is what comes to mind when thinking about the future of alternative payment models (APMs). It’s not because the health care ecosystem (let alone APMs) are poised to wreak horrific destruction upon us all.[1] Rather, the tornado analogy derives from the powerful and influential forces blowing the APM movement in multiple and conflicting directions. The result is swirl.

Currently, there are four “winds of change” exerting pressure on the payment reform movement.

- Priors: the historic direction payment reform was moving in, until…

- Pandemic: namely, the COVID-19 pandemic, which threw a flaming curveball at the entire delivery system.

- Politics: and policy, and the uncertainty that extends beyond the inauguration.

- Purchasers: whose advocacy motivated health plans to accelerate APM contracting – but may now be shifting their attention elsewhere.

Taken in turn, these four winds reveal why we find ourselves at this inflection point; and even though they cannot tell us exactly where the funnel will touch down, they reveal some important insights and predictions for what’s to come in 2021.

1. Priors: A gentle breeze toward financial risk

For a decade now, Catalyst for Payment Reform (CPR) has measured the amount of health care spend flowing through APMs. In partnership with the Health Care Payment Learning and Action Network (HCP-LAN), we tracked APM spend by type and by category, and charted the dramatic shift toward shared savings models. Today, although more than half of US health care spend flows through APMs in some form, the needle has barely moved on models that hold providers at risk financially for their cost and quality performance, and 95% of medical spend still rests on a fee-for-service foundation.

Health plans had a plan to move more providers up the continuum from shared savings contracts (upside only risk models) into shared risk contracts (also known as two-sided, at risk, or downside risk) models. Their strategy included efforts to anchor narrowed, high-performance networks around providers in 2-sided risk contracts, exchanging additional patient volume for provider’s accepting financial accountability for cost and quality outcomes; health plans promised more sophisticated population health management support and other “goodies” — like removing prior authorization requirements – to sweeten the deal.

But… that was all before 2020.

2. Pandemic: A sudden gust toward capitation? Or a consolidation-driven power vacuum?

Perhaps comparing the swirl around APMs to a tornado wastes the metaphor, because COVID-19 is the real tornado, tsunami, earthquake – any natural disaster will do. Its impact extends to every corner of the US economy, but no essential industry has been so profoundly disrupted as health care. Paradoxically, the central problem for many health care providers in a pandemic is the lack of demand for health care services. Patients postponed elective surgeries, visits to specialists, even well-care visits out of fear of contagion. Studies of health care utilization during the early months of the pandemic found that provider practices saw a 60% drop in visit volume, and estimate that practices stand to lose $323.1 billion in 2020.

This precipitous decline in volume and revenue has significant implications for providers’ financial viability – but the specific impact on payment reform blows in conflicting directions. On the one hand, the sudden utilization decline may induce demand for more stable cash flow and thus soften the ground for non-fee-for-service models including capitation. Moreover, even as in-person visits began to normalize, the trend toward telehealth continues for many specialties. The problem with telehealth? It doesn’t lend itself well to fee-for-service payment.

On the other hand, organizations like the Kaiser Family Foundation speculate that the sustained revenue deficits will exacerbate the trend toward provider consolidation. Despite influxes of cash from the Federal Government and some commercial health plans, providers may find it cost prohibitive to sustain an independent business model. If this comes to pass, and market power coalesces around large, multi-state delivery systems, health plans will find it increasingly difficult to wield negotiating leverage – especially around contracts that introduce financial risk.

What’s more, health plans and self-funded purchasers now face the perplexing task of trying to manage 2019’s total cost of care contracts. Historically low utilization could result in massive provider payouts — but may also be nullified if providers cannot achieve quality targets that require in-person care (e.g. the rate of childhood vaccinations, or Hba1c testing for people with diabetes). In acknowledgment of provider hardship during the pandemic, payers (including Medicare and Tennessee’s state Medicaid program) have given providers a “bye” year on quality reporting and APMs due to the pandemic, but now it’s unclear whether, if and how they will resume.

3. Politics/Policies: whipping up a frenzy of speculation – without any clear direction

According to health policy experts, the fact that the Democrats control all three branches of government means that we may see more policy and legislative momentum – even for health care, America’s “third rail.”.

That said, it’s too early to say how the federal government will advance payment reform models, especially when its top priority will be COVID-19. During his campaign, Biden expressed modest support for APMs as a strategy for reducing Medicare costs, but didn’t offer much specificity. Meanwhile, CMS Administrator, Seema Verma, gave a grim report on the Center for Medicare and Medicaid Innovation’s (CMMI’s) APM programs back in October 2020. Administrator Verma’s assessment of the CMMI APM pilots is that “they have lost billions of dollars, and just a handful have seen significant improvements on quality metrics—a weak return on investment for taxpayers.” The Secretary hinted toward a future of mandatory APMs that hold providers at risk financially, and pressed CMMI for more accurate data and analytics to support providers’ efforts to manage population health, but offered no other details on future direction for value-based payment models.

In a recent interview with Modern Healthcare, Verma offered more of the same, saying “We have to keep our foot on the gas when it comes to working toward value-based care. This is something that has bipartisan support.” A recent blog post by CMS Deputy Administrator and CMMI Director, Brad Smith, concluded with the nebulous outlook that the “road to value-based care will continue to be long and challenging.”

4. Purchasers: Fed up with waiting for the dust to settle

Studies have shown time and again that prices, not utilization, drive health care cost inflation in the United States. The most recent data, from the third edition of the RAND Corporation’s Hospital Pricing study, revealed that commercial hospital prices are an average of 247% of the prices that Medicare pays. At this point purchasers may be tired of waiting for health plans to deliver on promises to bend the cost curve through improved care coordination and quality bonuses.

At CPR, we know that purchasers are looking outside their health plans for solutions like reference-based pricing, episode bundled payment and alternative third-party administrators. Perhaps the more shocking news comes from the National Alliance of Healthcare Purchaser Coalitions, whose 2020 survey of self-insured purchasers found that nearly 80% support hospital price regulation, indicating a historic shift toward openness to government action. It’s a new day when the private sector embraces “the R word.”

Is there any signal in this noise?

It would be a mistake to draw a singular conclusion out of the vortex of winds blowing in multiple and often conflicting directions around APMs. However, CPR poses a series of scenarios for the future of health care payment reform and places reasonable bets on their likelihood of coming true in 2021.

Low probability scenarios:

- A massive influx of providers will take on shared risk contracts

- CMS will cease all APM pilots and dismantle CMMI

Medium probability scenarios

- Some independent primary care practices will shift to capitated payment models

- States – not the Federal Government – will be the champions of changing the market through regulation (to preserve competition and modulate price inflation). This scenario has a higher long-run probability and will vary state by state.

High probability scenarios:

- Some previously independent provider practices will be purchased by integrated delivery systems – or health plans – or others looking to diversify

- Purchasers who are committed to APMs will seek them out through other means, like contracting with a COE vendor, entering into a direct contract with a health system, or partnering with an RBP vendor

Finally, here’s one final scenario that we can guarantee for 2021: CPR will continue to be a beacon of clarity for purchasers, shining light on solutions that help them maximize the value of their benefit dollar. We hope you’ll join us on February 25, 2021 to hear from experts in the private sector, health economists, policy makers, and leaders of the payment reform movement during our Virtual Summit: The Aftermath of COVID-19: Experts Plot the Path Forward for Payment Reform. (Registration now open). Through webinars like this one and our continued research and analysis, CPR remains unflagging in our commitment to help purchasers navigate through these winds of change.

[1] Reasonable people may disagree on this point…

Dandelion flower photo by Saad Chaudhry on Unsplash.